The Epoch Times: Miami Is America’s Most Competitive Rental Market

When The Epoch Times reached out to discuss Miami’s fiercely competitive rental market, I wasn’t surprised. Renters are stepping into a whirlwind—rents climbing, inventory tight, and competition fierce. But behind every data point is a real person trying to find their place in this city. I shared that many of our clients moving to Miami, often choose to rent first—not just because it’s hard to buy, but because Miami is vast and layered, and they want to truly understand it before planting roots. My job, and the job of my 150+ agents at Avanti Way Realty – East Miami, is to guide them through that journey—cutting through the noise, avoiding the scams, and making sure their first step into Miami life feels less overwhelming and more like home. Because here, it’s not just about sunshine—it’s about strategy.

Miami’s rental demand is not seasonal. It’s powered now by more capital and jobs coming into the area, and the fact that Miami is a global destination.

Miami Is America’s Most Competitive Rental Market, Midwest Leads in Affordability

The report analyzed occupancy rates, vacancy duration, and renter competition.

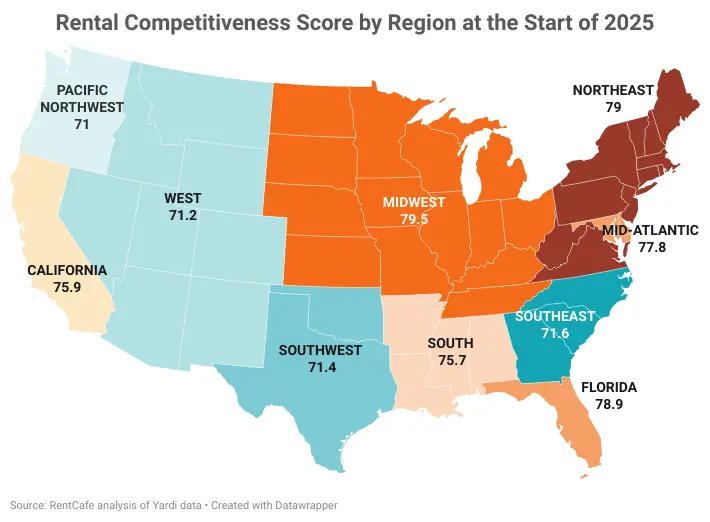

While the Midwest was the nation’s most competitive region for apartment hunters this year, Miami was ranked as the most competitive metropolitan area rental market in the United States.

Miami’s Rent Competitive Index (RCI) earned the top score of 93.1, exceeding the national average by 17.4 points. Suburban Chicago was a close second with an RCI of 88.4, followed by northern New Jersey, Lansing-Ann Arbor, Michigan, and suburban Philadelphia—all with scores above 85.

In preparing this report, RentCafe researched the top 139 largest markets in the nation. It focused on metrics including the percentage of apartments currently occupied, the number of days apartments were vacant, the number of potential renters competing for an apartment, and the percentage of renters who renewed their leases.

Doug Ressler, manager of business intelligence for Yardi Matrix, a sister division of RentCafe, told The Epoch Times that historically, Miami has been a popular destination because of the weather and vacation-like atmosphere.

“The fact that Miami also has no income tax is another reason why it continues to attract businesses and residents,” he said.

According to RentCafe’s report, vacant apartments in Miami are being scooped up faster than in any other U.S. metro area, within just 36 days and an average of 14 renters competing for each available unit. While Miami’s apartment supply increased by almost 1.5 percent over the past few months, some 96.3 percent of apartments are currently rented.

Ines Hegedus-Garcia, a managing partner and branch leader at Avanti Way Realty in North Miami Beach, told The Epoch Times that the average monthly rent can range from $3,500 to $4,000, depending on the neighborhood.

“I’ve heard complaints from tenants about rising rents, but it’s definitely more difficult to get a rental now,” she said.

“Plus, Miami’s rental demand is not seasonal. It’s powered now by more capital and jobs coming into the area, and the fact that Miami is a global destination.”

Hegedus-Garcia noted that many clients of the 150 real estate agents at her brokerage prefer to rent an apartment first before committing to purchase a property.

“Especially if they are new to the area, they want to take time to get to know Miami and the surrounding region first before deciding on a place to settle down,” she said.

Miami’s renters are a diverse group, ranging from young professionals to retirees from across the United States and around the world. One of the most popular neighborhoods is Brickell, Miami’s financial district.

“It’s very walkable with tons of restaurants, clubs, art, culture, and parks,” Hegedus-Garcia said. “And yes, it’s also one of the more expensive areas to live.”

Those who do find a rental they like typically stay for at least two years, and most potential renters find properties through real estate agents.

“There’s a lot of internet scams out there, so people will typically use an agent to help them,” she said.

Practically all of the newer buildings offer amenities such as a pool, gym, community center, and sometimes tennis or pickleball courts. Some rental communities even offer marinas with kayak or paddleboat facilities.

“I think Miami is going to continue to rank high for rental competitiveness,” Hegedus-Garcia said. “It’s a lot more than just sunshine here.”

When comparing the country’s regions, the Midwest had the highest ranking for rent competitiveness nationwide, with an RCI of 79.5. Affordability is listed as one of the main reasons, with areas such as Detroit and Grand Rapids, Michigan; Cincinnati; Milwaukee; and Kansas City, Missouri, ranking in the top 20 rental markets.

Courtesy of Rent Cafe

RentCafe listed the average rent for a one-bedroom apartment at $1,405 in Cincinnati and $1,276 in Kansas City.

Suburban Chicago is also credited with offering a more affordable option than downtown Chicago, where people are often priced out because of escalating rents.

“Chicago has been experiencing a lot of adaptive reuse of commercial conversions to residential buildings,” Ressler said.

To read the rest of the article, please visit ORIGINAL ARTICLE link