Miami and Miami Beach 4Q Elliman Reports 2014

Here’s our lastest episode of Elliman Reports for Miami Homes, Miami Condos, Miami Beach homes and Miami Beach condos – showing figures for the 4th quarter of 2014. Unlike our hyper local real estate market reports that we share on a regular basis like Miami Shores homes, Surfside homes or even Azure Condo Reports in Surfside, these reports are useful because they provide overall numbers and give you a general idea of how our Miami and Miami Beach real estate markets are doing. Nothing replaces a personally prepared market analysis for your own property, one that compares properties in the near vicinity of your home or condo. Or you can even request an automatic home value report here (by providing an email address): CHECK YOUR CURRENT HOME VALUE If you want to know how your particular area is doing, please email us at marketreports@miamism.com.

Miami Real Estate Market Report – 4Q 2014

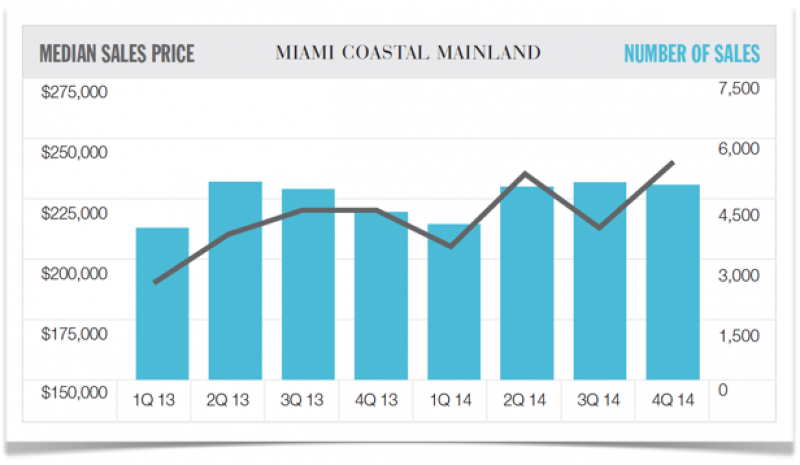

Quarterly Survey of Miami Coastal Mainland Sales for the 4th Quarter of 2014 shows number of sales increased, but were outpaced by the rise in inventory. All price indicators moved higher, double digit year-to-date growth and marketing time declined as negotiability edged higher.

Housing price indicators on Miami’s coastal mainland moved higher at the end of 2014. Median sales price increased 9.1% to $240,000 from the same period last year. Year to date, median sales price was up 17.5% to $235,000. Condos showed larger price gains than single family sales did in the fourth quarter. Condo median sales price was $210,000, up 20% and single family median sales was $270,000 up 5.2% over the same period. The luxury condo market showed the largest increase with a 46.7% rise in median sales price to $1,100,000. The luxury market is defined as the top 10% of all sales during the period. The large gain in all luxury condo price indicators was caused by a shift in the mix to a higher end product. The entry threshold for the luxury condo market was $693,500, 26.1% higher than the same period last year. Rising prices over the past few years has started to pull in more inventory across all market segments. Although levels remain low, overall condo and single family inventory is up 33.8% from the prior year total. Despite the rise in supply, days on the market, the number of days from the last price change to the sales date, fell 9.2% to 59 days.

Miami Condos Report

Large gains in all price indicators as sales of lower priced distressed sales declined. Rise in listing inventory increased faster than increase in sales. Days on market declined and listing discount increased. Absorption period expanded from prior year levels.

Miami Homes Report

Housing price indicators were mixed. Sales and inventory increased at a similar rate. Days on market fell as negotiability stabilized. Distressed prices increased more than non-distressed.

Miami Luxury Homes and Miami Luxury Condos Report

Condo price indicators surged, despite increase in inventory. Condo sales and days on the market rose. Single family price indicators declined as smaller sized sales increased. Single family inventory and marketing times edged higher. DOWNLOAD COPY OF ENTIRE 4Q 2014 MIAMI COASTAL MAINLAND SALES HERE\  This report will also include individual stats for cities of Aventura, downtown Miami, Coconut Grove, Coral Gables, Brickell, South Miami, Pinecrest and Palmetto Bay.

This report will also include individual stats for cities of Aventura, downtown Miami, Coconut Grove, Coral Gables, Brickell, South Miami, Pinecrest and Palmetto Bay.

Miami Beach Real Estate Market Report – 4Q 2014

Quarterly survey of Miami Beach / Barrier Islands Sales for the 4th quarter of 2014 shows double-digit growth of all price indicators, sales declined as inventory expanded and marketing time and negotiability fell.

Rising housing prices within the Miami Beach and Barrier Island region are pulling in additional re-sale inventory to a market that has long seen limited supply that held back sales. Despite the 20% increase in listing inventory, there was a 7.9% decline to 1,061 condo and single family sales from the prior year quarter. The absorption period, the number of months to sell all existing inventory at the current pace of sales, increased to 11.3 months from 8.6 in the prior year quarter. Rising prices and a strengthening U.S. dollar are helping to temper the blistering pace of the past several years. Median sales prices for condo and single family properties combined, increased 14.4% to $400,000 from the prior year period, consistent with the year-to-date median sales price increase of 14.3%. In the luxury market, defined as the top 10% of sales, luxury condo median sales price was up 47.2% to $2,650,000 with an entry threshold of $1,610,000, up 26.3% respectively from the prior year quarter. Luxury single family median sales price declined 18.9% to $5,700,000 from prior year quarter with an entry threshold of $4,385,000, down 6.7% over the same period.

Miami Beach Condos Report

Price indicators for Miami Beach condos increased sharply. Listing inventory increased as sales declined and marketing time and negotiability slipped.

Miami Beach Homes Report

Price indicators for Miami Beach homes fell short of prior year results. Sales increased at about the same rate as listing inventory and negotiability decreased as marketing time stabilized.

Miami Beach Luxury Homes and Miami Beach Luxury Condos Report

Price indicators for Miami Beach luxury condos surged as inventory trended higher. Entry threshold surged as shift to higher end product continued. Price indicators for Miami Beach luxury homes showed average size of sale dropped sharply, pulling price indicators down. Listing inventory expanded as marketing time slipped. DOWNLOAD COPY OF ENTIRE 4Q 2014 MIAMI BEACH / BARRIER ISLANDS SALES HERE This report will also include individual stats for cities of Sunny Isles, Bal Harbour, Bay Harbor, Surfside, North Bay Village, Miami Beach Islands, North Beach, Mid-Beach, South Beach, Key Biscayne and Fisher Island. **The Douglas Elliman Report series is recognized as the industry standard for providing the state of the residential real estate market. The report includes an extensive suite of tools to help readers objectively identify and measure market trends, provide historical context to current information and provide comprehensive analysis of the results. Prepared by Miller Samuel, Inc. CHECK YOUR CURRENT HOME VALUE GET A FREE SELLER GUIDE

**The Douglas Elliman Report series is recognized as the industry standard for providing the state of the residential real estate market. The report includes an extensive suite of tools to help readers objectively identify and measure market trends, provide historical context to current information and provide comprehensive analysis of the results. Prepared by Miller Samuel, Inc. CHECK YOUR CURRENT HOME VALUE GET A FREE SELLER GUIDE