Misleading Dade County Property Tax Bills

We wanted to bring something to your attention about property tax bills issued by Miami-Dade County on November 1, 2012. This may not necessarily apply to you, but please double check your bill to avoid surprises next year. The tax consultants we have been using for years call this bill “confusing at best, and at worst misleading.”

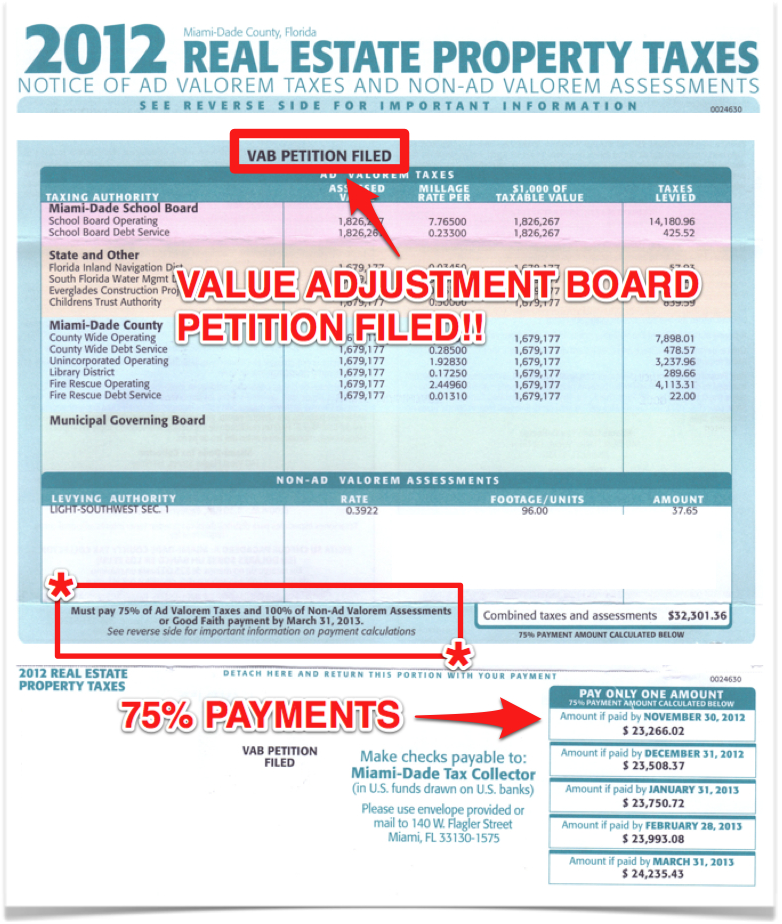

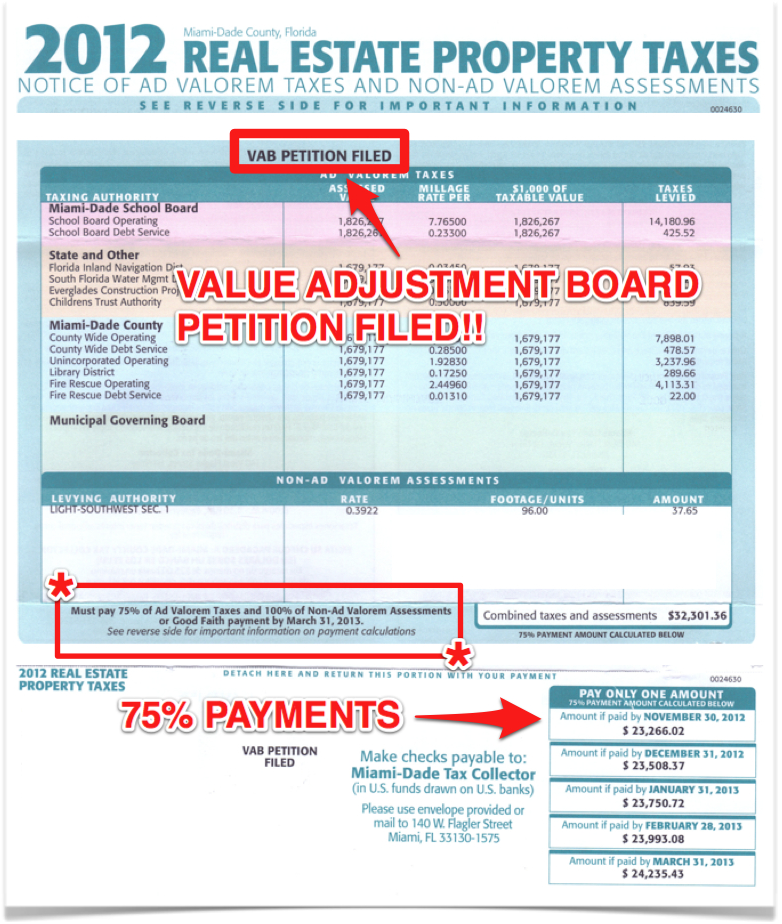

If you have ever filed a petition with the Value Adjustment Board (VAB) to get a reduction in your property taxes, this will be pertinent to you. With commercial properties we manage, we hire tax consultants on an annual basis to file petitions with the VAB. If they achieve a reduction in taxes, property owners get a reimbursement from Dade County usually a year later. This year, Miami-Dade Tax Collector threw a monkey wrench in the equation – I wonder if they did it to see who was paying attention. Check out a sample bill bellow (property and owner information omitted for obvious reasons.)

Bills are sent out on November 1, 2012 and if you pay before the due date of April 1, 2013, you get a discount. As you can see above, the discount for paying before November 30th, 2012 is considerable and most people choose to pay that amount in order to take advantage of the savings. Here’s where it gets interesting. If you happen to have filed a VAB petition before the bills went out, the discounted amounts are not based on the full amount of the tax owed.

Our tax consultants explain:

The Tax Collector has shown the amount due for discounted payments as a portion of the total tax, i.e., they show 75% of the ad valorem tax and 100% of the non-ad valorem tax, with discounts. These are the minimal payments required to avoid dismissal of your Value Adjustment Board appeal, as established by a change in the law more than a year ago.

Fortunately, the correct tax bill can still be viewed on line at www.miamidade.gov/proptax. We urge our clients to pay the full tax. If we successfully challenge your assessment, you will receive a refund, plus interest accrued after April 1, 2013.

Finally, if you make a partial payment and your assessment is reduced by less than 25%, you will eventually receive an additional tax bill plus interest.

Our clients are burdened by a County which runs one year late on Board hearings and a Tax Collector who then sits on refunds for nearly six more months. This is yet another example of government operating without a grip on reality. They could have conferred with us or checked with other Counties prior to changing their bill. It seems like we must constantly clean up their mess.

So the real amount owed by the example above is $32,301.36. The discounts are as follows:

- 4% if paid in November – $31,009.31

- 3% if paid in December – $31,332.32

- 2% if paid in January – $31,665.33

- 1% if paid in February – $31,978.35

Just remember that if you choose to pay 75% of the payment as the bill is printed, you may end up paying interest next year for the confusion. It makes you wonder if the county is relying on this additional interest money. Check your bill twice and know exactly what you’re paying!